Author: sleepy.txt

Original Title: JPMorgan Defects from Wall Street: Hoarding Silver, Securing Gold, Shorting Dollar Credit

JPMorgan, the most loyal "gatekeeper" of the old dollar order, is now personally toppling the high walls it once swore to defend.

According to market rumors, in late November 2025, JPMorgan relocated its core precious metals trading team to Singapore. If the geographical move is merely superficial, then its core represents a public defection from the Western gold-power system.

Looking back over the past half-century, Wall Street was responsible for constructing a vast credit illusion with the dollar, while London, acting as the "heart" of Wall Street's gold-power empire across the Atlantic, maintained pricing dignity with deeply buried vaults. The two complemented each other, weaving an absolute control network over precious metals for the Western world. And JPMorgan was supposed to be the final, and strongest, line of defense.

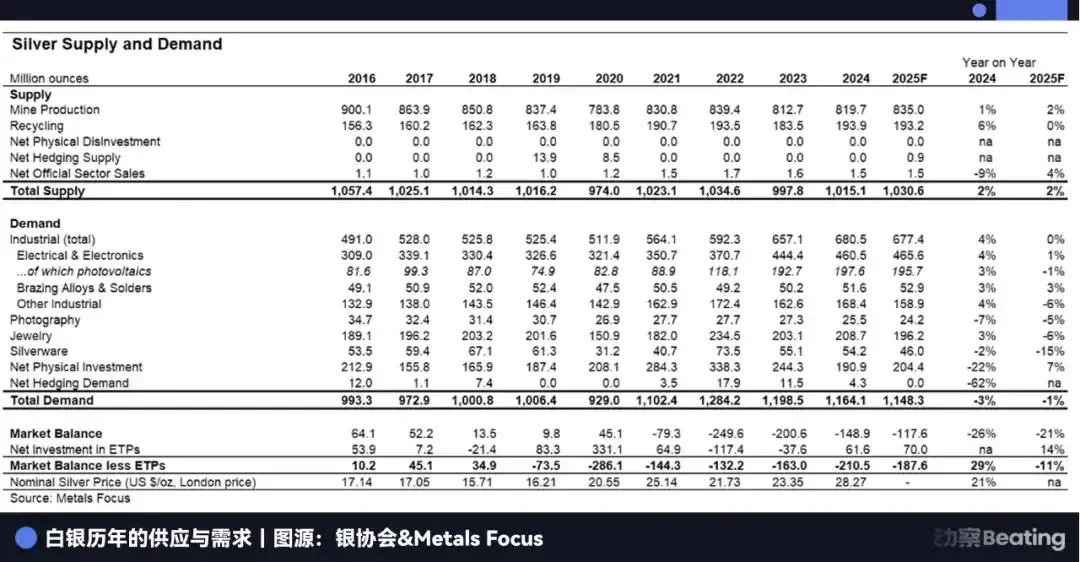

Clues were scattered, the trail laid long ago. Amid the official silence and lack of comment on the rumors, JPMorgan executed a stunning asset transfer: approximately 169 million ounces of silver were quietly moved from the "deliverable" category to the "non-deliverable" category in COMEX vaults. Roughly calculated based on public data from the Silver Institute, this is equivalent to nearly 10% of the global annual supply, effectively locked away on the books.

In the brutal game of commercial competition, scale itself is the toughest attitude. This hoarded mountain of over 5,000 tons of silver is seen by many traders as筹码 (chips) prepared in advance by JPMorgan to争夺 (contend for) pricing power in the next cycle.

Meanwhile, thousands of kilometers away, Singapore's largest private vault, The Reserve, timely launched its second phase of expansion, pushing the total vault capacity to a level of 15,500 tonnes. This infrastructure upgrade, planned five years ago, gives Singapore sufficient底气 (confidence/backing) to承接 (receive/handle) the massive wealth flooding out from the West.

JPMorgan, with its left hand, locks down the liquidity of physical metal in the West, creating panic; with its right hand, it prepares a safe harbor in the East, ready to reap the rewards.

What prompted this giant's defection is the increasingly undeniable fragility of the London market. At the Bank of England, gold withdrawal times have stretched from days to weeks, while the silver lease rate once soared to a historical high of 30%. For those familiar with this market, this signals one thing at least: everyone is scrambling for metal, and the physical assets in the vaults are starting to look stretched thin.

The shrewdest market makers are often the vultures with the most acute sense for the smell of death.

In this winter, JPMorgan demonstrated the嗅觉 (sense of smell) of a top market maker. Its departure marks the impending end of the half-century-long "paper gold" game that turned stone into gold. When the tide goes out, only those holding tightly to their heavy physical筹码 (chips) will get a ticket to the next thirty years.

The End of Alchemy

The root of all trouble was sown half a century ago.

In 1971, when President Nixon severed the dollar's link to gold, he effectively pulled the last anchor of the global financial system. From that moment, gold was demoted from a rigidly redeemable currency to a financial asset redefined by Wall Street.

In the subsequent half-century, bankers in London and New York invented a sophisticated "financial alchemy." Since gold was no longer money, they could, like printing banknotes, create countless "contracts" representing gold out of thin air.

This is the vast derivatives empire built by the LBMA (London Bullion Market Association) and COMEX (Commodity Exchange Inc.). In this empire, leverage is sovereignty. For every bar of gold sleeping in a vault, there are 100 delivery warrants circulating in the market. And on the silver betting table, this game is even more疯狂 (crazy).

This system of "paper wealth" operated for half a century relying entirely on a fragile gentleman's agreement: the vast majority of investors were only in it for price speculation and would never actually try to take delivery of that heavy metal.

However, the designers of this game overlooked a "gray rhino" charging into the room—silver.

Unlike gold, eternally stored as wealth deep underground, silver plays the role of a "consumable" in modern industry. It is the lifeblood of photovoltaic panels and the nerves of electric vehicles. According to data from the Silver Institute, the global silver market has been in a structural deficit for five consecutive years, with industrial demand accounting for nearly 60% of total demand.

Wall Street can type out unlimited dollars, but it cannot conjure an ounce of conductive silver out of thin air.

When physical inventories are devoured by the real economy, the billions of contracts on paper become a tree without roots. By the winter of 2025, this paper-thin facade was pierced.

The first red flag was price anomalies. In normal futures logic,远期价格 (forward prices) are usually higher than现货价格 (spot prices), known as "contango." But in London and New York, the market exhibited extreme "backwardation." If you want to buy a silver contract for six months later, it's calm; but if you want to take the silver bars home now, not only do you need to pay a high premium, but you also face weeks of waiting.

Queues formed outside the Bank of England's vaults, registered silver inventories on COMEX fell below safety red lines, and the ratio of open interest to physical inventory一度 (once) soared to 244%. The market finally understood the terrifying reality: the physical metal and paper contracts were splitting into two parallel universes. The former belongs to those who own factories and vaults, the latter to speculators still asleep in the old dream.

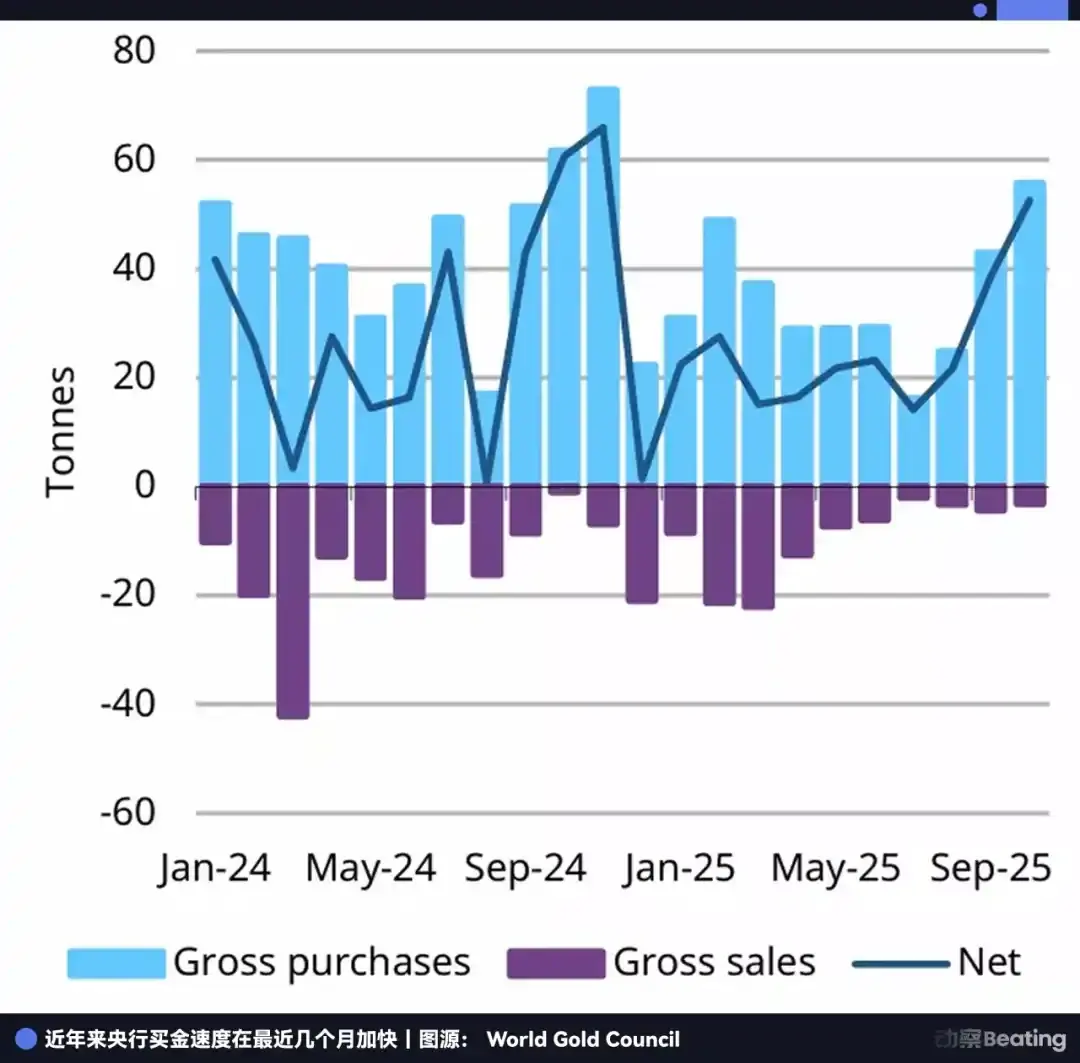

If silver shortage is due to the吞噬 (devouring) by the industrial beast, then the outflow of gold is due to a national-level "bank run." Central banks, once the staunchest holders of dollars, are now at the front of the queue for withdrawal.

Although gold prices in 2025 were at historical highs, leading some central banks to tactically slow their purchasing pace, strategically, "buying" remains the only action. The latest data from the World Gold Council (WGC) shows that in the first 10 months of 2025, global central banks累计净购入 (cumulatively net purchased) 254 tonnes of gold.

Let's look at this buyer list.

Poland, after a 5-month pause in gold buying, suddenly returned to the market in October,扫货 (sweeping up) 16 tonnes in a single month, forcefully pushing its gold reserve ratio to 26%. Brazil, increased holdings for two consecutive months, with total reserves climbing to 161 tonnes. China, having resumed increases since November 2024, has appeared on the buyer list for the 13th consecutive month.

These countries are不惜用 (not hesitating to use) precious foreign exchange to acquire heavy gold bars and ship them back home. In the past, everyone trusted U.S. Treasuries because they were "risk-free assets"; now, everyone is疯抢 (franticly grabbing) gold because it has become the only shelter against "dollar credit risk."

Although Western mainstream economists still argue, claiming the paper gold system provides efficient liquidity and the current crisis is merely a temporary logistics issue.

But paper cannot contain fire, and now paper cannot contain gold either.

When the leverage ratio reaches 100:1, and that single "1" is being坚决地 (resolutely)搬回家 (taken home) by central banks, the remaining "99" paper contracts face an unprecedented liquidity mismatch.

The London market is now trapped in a typical short squeeze困境 (dilemma). Industrial giants are scrambling for silver to保生产 (guarantee production), while central banks are死死锁住 (firmly locking up) gold as national strategic reserves. When all counterparties demand physical delivery, the pricing model built on credit fails. Whoever controls the physical metal controls the power to define price.

And JPMorgan, the former master magician most skilled at playing paper contracts, clearly saw this future earlier than anyone else.

Rather than being a殉葬者 (martyr) for the old order, it prefers to be a合伙人 (partner) in the new order. This repeat offender, fined $920 million for market manipulation over the past eight years, its departure is by no means a pang of conscience, but a precise bet on the flow of global wealth over the next thirty years.

It is betting on the collapse of the "paper contract" market. Even if it doesn't collapse immediately, that infinitely放大 (amplified) leverage will迟早 (sooner or later) be slashed, round after round. The only truly safe assets are the visible, tangible metals in the warehouse.

Defecting from Wall Street

If the paper gold and silver system is compared to a glitzy casino, then over the past decade, JPMorgan was not only the bouncer maintaining order but also the dealer most skilled at cheating.

In September 2020, to settle U.S. Department of Justice charges of manipulating the precious metals markets, JPMorgan paid a record $920 million settlement. In the thousands of pages of investigation documents disclosed by the DOJ, JPMorgan's traders were described as masters of the art of spoofing.

They habitually used an extremely cunning hunting technique: a trader would instantly place thousands of contracts on the sell side, creating the illusion of an imminent price crash, inducing panic selling by retail investors and high-frequency trading algorithms; then cancel the orders at the moment of the crash, and反过来 (conversely) voraciously吞食 (devour) the bloodied筹码 (chips) at the bottom.

According to statistics, Michael Nowak, JPMorgan's former global head of precious metals, and his team人为制造 (artificially created) instant crashes and surges in gold and silver prices tens of thousands of times over an eight-year period.

At the time, outsiders generally attributed this to Wall Street's usual greed. But five years later, with the puzzle piece of that 169 million ounces of silver inventory placed on the table, a darker interpretation began to circulate in the market.

In some readings, JPMorgan's past "market operations" can hardly be seen anymore as just trying to earn a bit more from high-frequency trading. It更像 (looks more like) a slow and prolonged accumulation of筹码 (chips). They were violently suppressing prices in the paper market, creating the错觉 (illusion) that prices were being capped, while quietly accumulating physical metal on the other end.

This former guardian of the old dollar order has now transformed into the most dangerous掘墓人 (gravedigger) of that very order.

In the past, JPMorgan was the biggest short seller in paper silver, the ceiling suppressing gold and silver prices. But now, with the physical筹码 (chips) swapped, they have overnight become the biggest long.

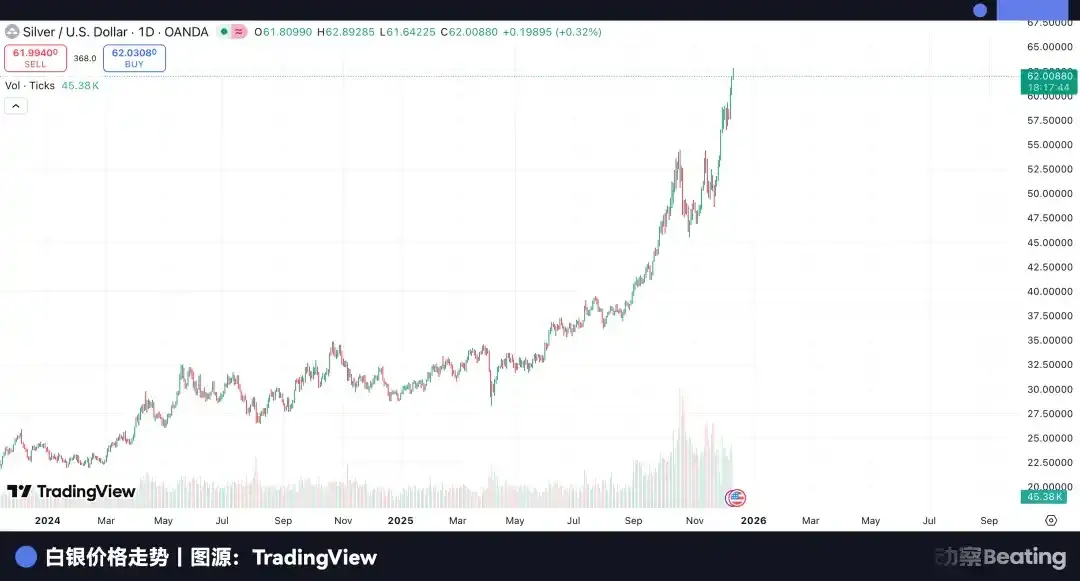

Market gossip is never in short supply. Rumors suggest that the recent surge in silver prices from $30 to $60 was orchestrated by JPMorgan itself. Such claims naturally lack evidence, but they suffice to indicate one thing: in many people's minds, it has shifted from being the manipulator shorting paper silver to the biggest bull in physical assets.

If this deduction holds true, then we are witnessing the most brilliant, yet coldest, mutiny in business history.

JPMorgan knows better than anyone that the U.S. regulatory fist is tightening inch by inch, and that life-threatening game of paper contracts has reached its end.

This also explains its particular affinity for Singapore.

In the U.S., every trade can be flagged as suspicious by AI surveillance systems; but in Singapore, in those private fortresses不属于 (not belonging to) any national central bank, gold and silver are completely depoliticized. There is no long-arm jurisdiction here, only extreme protection of private property.

JPMorgan's突围 (breakout) is by no means a solo act.

Around the same time the rumors fermented, a top-level agreement on Wall Street was quietly reached. Although there was no physical collective relocation, strategically, the giants completed a惊人的同步转向 (astonishing synchronized pivot). Goldman Sachs aggressively set its 2026 gold price target at $4,900, and Bank of America directly called for a sky-high price of $5,000.

In the era dominated by paper gold, such target prices sounded like fantasy; but if we shift our perspective back to the physical side, looking at central banks' buying节奏 (rhythm), the inventory changes in vaults, this number begins to have space for serious discussion.

Wall Street's smart money is quietly moving positions: doing less shorting of gold, adding more physical holdings; U.S. Treasuries in hand may not be fully dumped, but gold, silver, and other physical assets are being gradually stuffed into investment portfolios. JPMorgan moved the fastest and most decisively because it not only wants to survive but also to win. It doesn't want to sink with the paper gold empire; it wants to take its algorithms, capital, and technology to a place that has not only gold but also a future.

The problem is, that place already has its own master.

When JPMorgan's private jet lands at Singapore's Changi Airport, looking north, it will find a more庞大 (massive) opponent早已在那里筑起了高墙 (has long since erected high walls there).

The Tide Ebbs and Flows

While London traders were still anxious about the drying up liquidity of paper gold, thousands of kilometers away on the banks of Shanghai's Huangpu River, a massive physical gold empire had long completed its primitive accumulation.

Its name is the Shanghai Gold Exchange (SGE).

In the financial landscape dominated by the West, the SGE is an outright异类 (anomaly). It rejected the virtual game built on credit contracts prevalent in London and New York, and from its inception, adhered to a近乎偏执的铁律 (near-fanatic iron rule): physical delivery.

These four words, like a steel nail,精准地钉在了 (precisely hit) the Achilles' heel of the Western paper gold game.

In New York's COMEX, gold is often just a string of flickering numbers, with the vast majority of contracts closed out before expiration. But in Shanghai, the rules are "full amount交易 (trading)" and "集中清算 (centralized clearing)."

Every transaction here must be backed by real gold bars lying in a vault. This not only eliminates the possibility of infinite leverage but also makes "shorting gold" extremely difficult because you must first borrow real gold before you can sell it.

In 2024, the SGE delivered staggering results: annual gold trading volume reached 62,300 tonnes, a 49.9% increase from 2023; trading value soared to 34.65 trillion yuan, an increase of nearly 87%.

While the physical delivery rate on New York's COMEX is甚至不足 (even less than) 0.1%, the Shanghai Gold Exchange has become the world's largest physical gold reservoir, continuously absorbing global gold stocks.

If the inflow of gold is a national strategic reserve, then the inflow of silver is the "physiological craving" of Chinese industry.

Wall Street speculators can use paper contracts to bet on prices, but as the world's largest manufacturing base for photovoltaics and new energy, Chinese factory owners don't want contracts—they must get real silver to start production. This rigid industrial demand makes China the world's largest precious metals black hole, relentlessly吞噬着 (devouring) Western stocks.

This path of "West-to-East gold flow" is busy and隐秘 (clandestine).

Take the journey of a single bar. In Switzerland's Ticino canton, the world's largest gold refineries (like Valcambi, PAMP) are operating day and night. They are performing a special "blood exchange" task: melting down the standard 400-ounce bars shipped from London vaults, refining them, and recasting them into 1-kilogram bars of "Shanghai Gold" standard, with a purity of 99.99%.

This is not just a physical reshaping but a monetary属性更迭 (attribute change).

Once these bars are melted into 1-kg规格 (specifications) and stamped with the "Shanghai Gold" mark, they are almost impossible to flow back to the London market. To send them back, they would have to be melted again and re-certified, at extremely high cost.

This means that once gold flows east, it is like river water entering the sea, never to return. The tide ebbs and flows, the waves of the mighty river never cease.

On the tarmac of major airports worldwide, armored convoys marked with Brink's, Loomis, or Malca-Amit logos are the movers of this great migration. They continuously fill Shanghai's vaults with these recast bars, becoming the physical cornerstone of the new order.

Whoever controls the physical metal controls the discourse. This is the strategic depth repeatedly emphasized by SGE's head, Yu Wenjian, in establishing the "Shanghai Gold" benchmark price.

For a long time, global gold pricing power was firmly locked into the London PM fix, because that reflected the will of the dollar. But Shanghai is trying to sever this logic.

This is a strategic hedge of the highest order. As China, Russia, Middle Eastern countries, and others begin to form an invisible "de-dollarization" alliance, they need a new common language. This language is not the Renminbi, nor the Ruble, but gold.

Shanghai is the translation center for this new language. It is telling the world: if the dollar is no longer trustworthy, then trust the real gold and silver in your own warehouse; if paper contracts can default, then trust the Shanghai rule of spot exchange.

For JPMorgan, this is both a huge threat and an opportunity that cannot be ignored.

To the West, it can no longer return, because there is only depleted liquidity and tightening regulation; to the East, it must face the behemoth that is Shanghai. It cannot directly conquer Shanghai because the rules there don't belong to Wall Street, and the walls there are too thick.

The Final Buffer Zone

If Shanghai is the "heart" of the Eastern physical asset empire, then Singapore is the "front line" in this East-West confrontation. It is not merely a geographical transit point but the last line of defense carefully chosen by Western capital in the face of the Eastern rise.

Singapore, this city-state, is投入 (investing) with near疯狂 (craziness) to build itself into the "Switzerland" of the 21st century.

Le Freeport, located next to the runways of Changi Airport, is the best window into Singapore's ambitions. This freeport with independent judicial status is, both physically and legally, a perfect "black box." Here, the movement of gold is stripped of all cumbersome administrative supervision; the entire process, from aircraft landing to bar storage, is completed in a completely closed, tax-free, and extremely private loop.

At the same time, another super vault named The Reserve has been on high alert since 2024. This fortress covering 180,000 square feet has a designed total capacity of up to 15,500 tonnes. Its selling point is not only meter-thick reinforced concrete walls but also a privilege granted by the Singapore government—complete exemption from Goods and Services Tax (GST) on Investment Precious Metals (IPM).

For market makers like JPMorgan, this is an irresistible诱惑 (temptation).

But if it were only about taxes and vaults, JPMorgan could have chosen Dubai or Zurich. Its ultimate choice of Singapore hides deeper geopolitical calculations.

On Wall Street, directly moving the business core from New York to Shanghai would be tantamount to "defecting to the enemy," which is suicidal in the current treacherous international political climate. They urgently need a pivot, a safe haven that allows them to access the vast physical market of the East while still feeling politically secure.

Singapore is the perfect choice.

It commands the Strait of Malacca, connecting dollar liquidity from London and touching the physical demand from Shanghai and India.

Singapore is not only a safe haven but also the largest transit station connecting two分裂的 (divided) worlds. JPMorgan is trying to establish a sun-never-sets trading loop here: fixing in London, hedging in New York, hoarding in Singapore.

However, JPMorgan's clever plan is not without vulnerabilities. In the competition for Asian pricing power, it cannot bypass its most formidable opponent—Hong Kong, China.

Many mistakenly believe Hong Kong has fallen behind in this round of competition, but the opposite is true. Hong Kong possesses a core王牌 (trump card) that Singapore cannot replicate: it is the only channel for the offshore flow of the Renminbi.

Through the "Gold Connect" between Hong Kong and Shanghai, the Chinese Gold & Silver Exchange Society (CGSE) is directly connected to the Shanghai Gold Exchange. This means that gold traded in Hong Kong can directly enter the delivery system of mainland China. For capital that truly wants to embrace the Chinese market, Hong Kong is not "offshore" but an extension of "onshore."

JPMorgan chose Singapore, betting on a hybrid model of "Dollar + Physical," attempting to build a new offshore center on the ruins of the old order. Meanwhile, old British banks like HSBC and Standard Chartered continue to heavily invest in Hong Kong, betting on a future of "Renminbi + Physical."

JPMorgan thought it had found a neutral safe haven, but in the meat grinder of geopolitics, there is no true "middle ground." Singapore's prosperity is essentially the result of spillover from the Eastern economy. This seemingly independent luxury yacht is already locked into the gravitational field of the Eastern continent.

As Shanghai's gravitational pull grows stronger, as the Renminbi-denominated gold landscape expands, and as China's industrial machine continues to吞噬掉 (devour) the physical silver on the market, Singapore may no longer be a neutral safe haven. JPMorgan will have to make another fateful choice.

The Cycle Restarts

There may eventually be an official explanation for the rumors about JPMorgan, but it no longer matters. In the business world,敏锐的资本 (keen capital) always senses the tremors of the crust first.

The epicenter of this tremor is not in Singapore, but deep within the global monetary system.

For the past fifty years, we grew accustomed to the "paper contract" world dominated by dollar credit. It was an era built on debt, promises, and the illusion of infinite liquidity. We thought that as long as the printing presses were running, prosperity could be perpetual.

But now, the wind has彻底变了 (completely changed).

When central banks不惜代价 (spare no cost) to bring gold back to their countries, when global manufacturing giants begin to焦虑 (anxiously) compete for the last piece of industrial silver, we see the return of an ancient order.

The world is slowly but firmly transitioning from the ethereal credit货币体系 (monetary system) back to a tangible physical asset system. In this new system, gold is the measure of credit, and silver is the measure of production capacity. One represents the bottom line of safety, the other the极限 (limit) of industry.

In this long migration, London and New York are no longer the only endpoints, and the East is no longer just a manufacturing factory. New rules of the game are being written; new centers of power are forming.

The era where Western bankers defined the value of gold and silver is slowly dying. Gold and silver remain silent, but they have answered all questions about the times.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush